OKX Reports Decline in BTC and USDT User Holdings in 32nd Proof-of-Reserves Audit

OKX’s 32nd Proof-of-Reserves: BTC and USDT User Balances Fall, ETH on the Rise

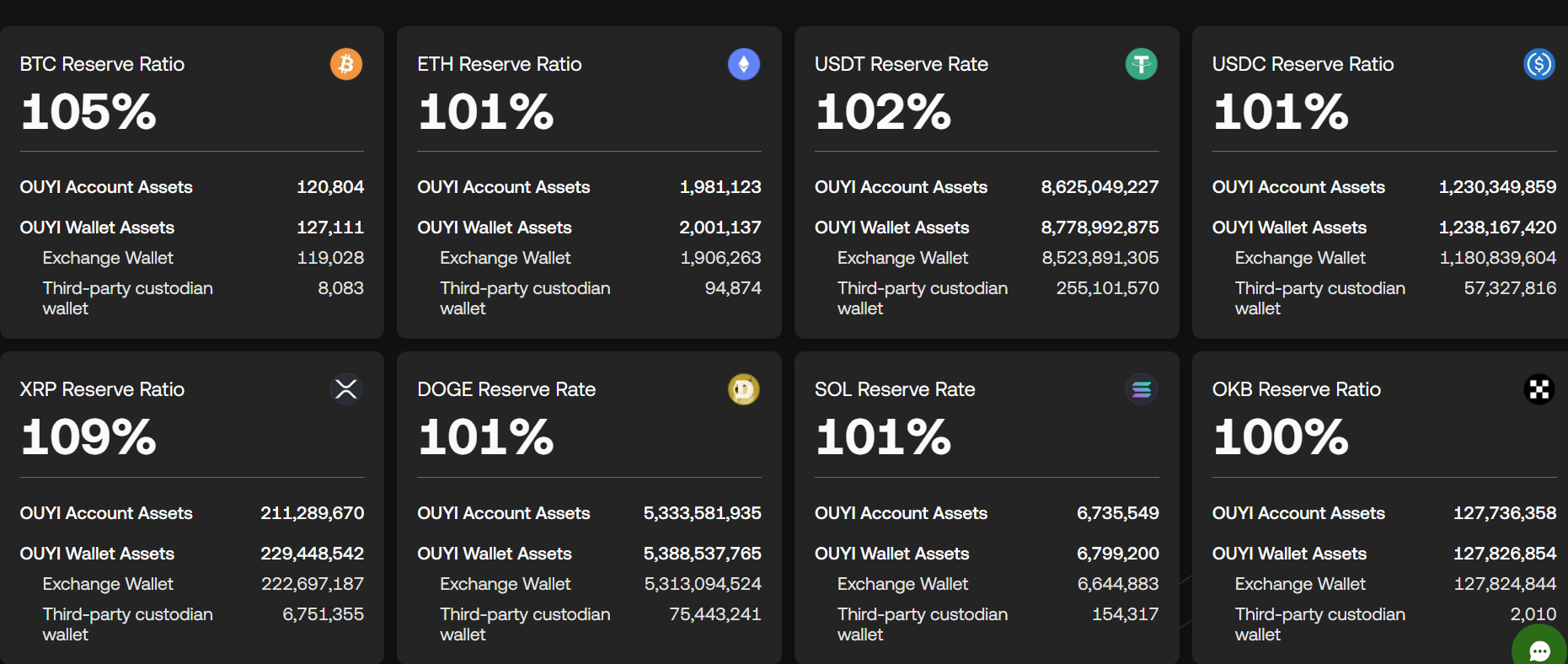

Leading crypto exchange OKX has published its 32nd proof-of-reserves (PoR) report, offering an updated snapshot of its reserve transparency as of June 14, 2025. While the platform continues to maintain reserves above 100% for all major supported assets, a notable shift in user behavior is emerging—particularly in Bitcoin (BTC) and Tether (USDT) holdings.

BTC and USDT Holdings Drop in June

According to the report released on June 30, Bitcoin user holdings fell by 4,360 BTC compared to the previous month, marking a 3.48% decline from 125,164 BTC on May 10 to roughly 120,804 BTC in June. At current market prices, this represents a decrease of over $470 million in BTC balances.

USDT holdings also declined, though more moderately. Users held 1.44% less USDT than the previous month, reflecting a drop of $126.4 million.

Ethereum Holdings Surge Over 6%

In contrast to BTC and USDT, Ethereum (ETH) user deposits saw a notable increase. The platform recorded a 6% rise in ETH holdings, equating to an additional 110,153 ETH or roughly $272.8 million in user wallets since May.

This suggests that users are showing greater confidence in ETH—or potentially repositioning portfolios in anticipation of market moves or network developments.

OKX Reserves Remain Fully Collateralized

Despite the shift in user balances, OKX’s reserves remain robust. All tracked assets—BTC, ETH, SOL, USDT, and ETC—are backed at over 100%, meaning the exchange holds more in reserves than the total customer deposits for each asset.

As of June 14:

- Ethereum Classic (ETC) leads with a reserve ratio of 107%

- Bitcoin holds a healthy 105% reserve coverage

- Other assets, including Solana (SOL) and Tether (USDT), also remain fully backed

“This isn’t just about compliance—it’s about trust,” the OKX team emphasized, reinforcing the platform’s commitment to transparency.

OKX released its 32nd proof-of-reserves report on June 30 | Source: OKX

OKX released its 32nd proof-of-reserves report on June 30 | Source: OKX

Related: OKX Executive Urges Focus on Real-World Value Amid RWA Tokenization Boom

Why Are Users Withdrawing Bitcoin?

The drop in user-held BTC may point to a growing shift toward self-custody. As crypto investors become more conscious of exchange risk, especially in light of past platform collapses, many are choosing to transfer their BTC to cold wallets.

Other possible reasons include:

- Market caution amid geopolitical uncertainty (e.g., U.S. Federal Reserve rate decisions, Middle East tensions)

- Profit-taking after BTC rebounded to $105,000 following a temporary dip

- A rotation into alternative assets like ETH or stablecoins

Conclusion: Market Sentiment Shifts, But Confidence in OKX Stays Strong

While BTC and USDT holdings on OKX are trending downward, the exchange continues to meet industry-leading standards in reserve transparency. Meanwhile, rising ETH balances suggest traders are actively adjusting strategies, perhaps positioning for future growth or DeFi opportunities.

For investors, these user behavior changes highlight the evolving dynamics of custody preferences, asset allocation, and market risk perception in today’s crypto environment.

Related: OKX Relaunches DEX Aggregator With Enhanced Security After Lazarus Group Misuse

Disclaimer: The content on this website is for informational purposes only and does not constitute financial or investment advice. We do not endorse any project or product. Readers should conduct their own research and assume full responsibility for their decisions. We are not liable for any loss or damage arising from reliance on the information provided. Crypto investments carry risks.